Powering Escrow Operations

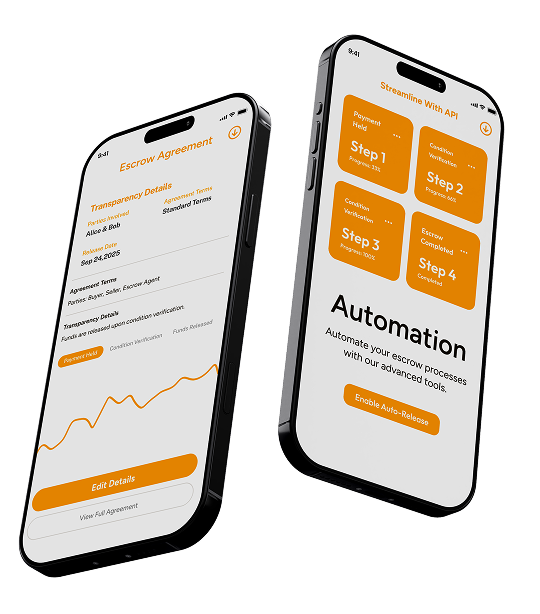

Use escrow accounts to hold payments safely until all agreed conditions are met. Automate releases, ensure compliance, and maintain complete transparency. Ideal for marketplaces, services, and B2B agreements looking to simplify high-stake transactions without worry.

.png)

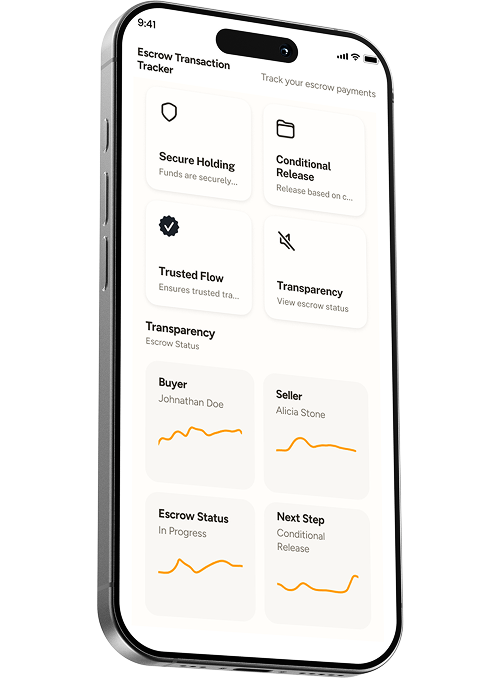

Funds stay securely held without access for either party until all agreed-upon terms have been completely met and validated successfully.

Money moves only when predefined steps are met, such as delivery, approvals, or timelines, ensuring fair outcomes for all stakeholders.

Escrow ensures no early releases or fund misuse, reducing disputes and reinforcing platform credibility across various business models.

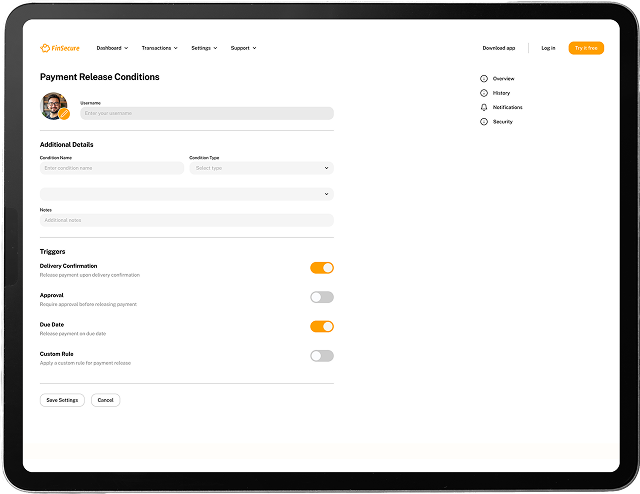

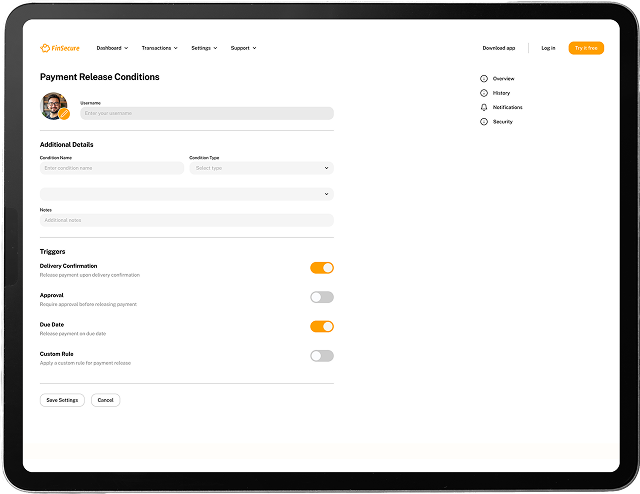

Define your own triggers and rules for releasing payments, such as delivery confirmation, approvals, or due dates, ensuring smooth and controlled disbursal without manual overhead or dependency on external parties or communication.

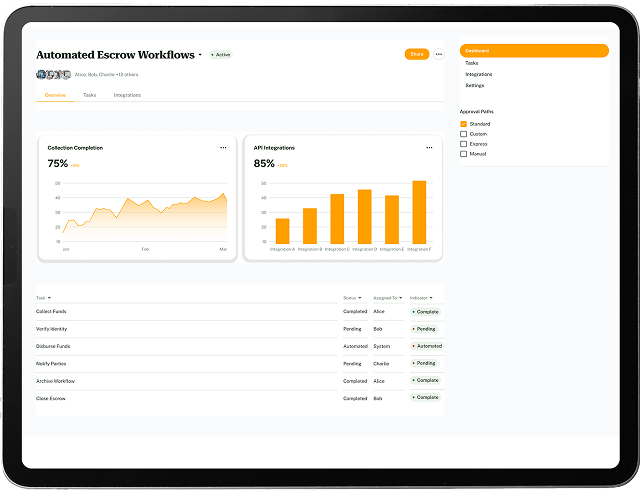

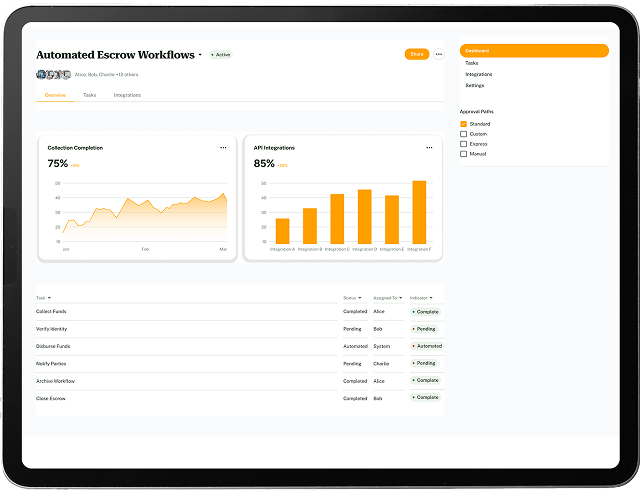

Manage all collections and disbursals with minimal effort. Reduce manual tasks, eliminate repetitive actions, and streamline your escrow lifecycle with clean workflows powered by APIs and customizable approval mechanisms.

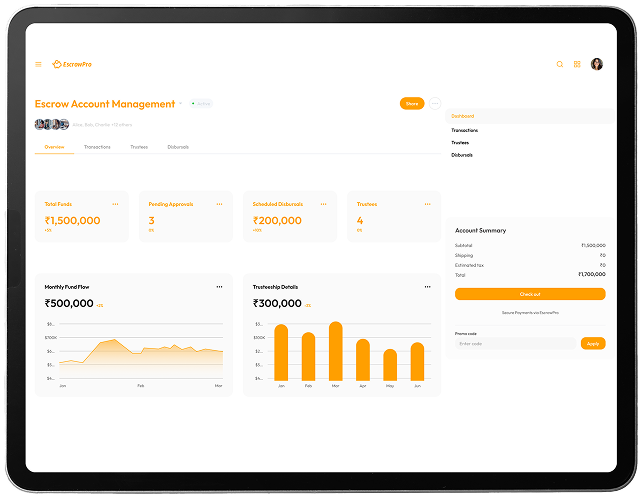

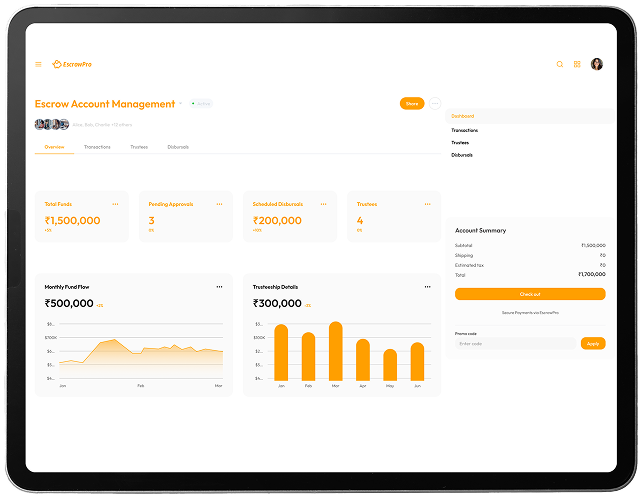

Manage everything from account setup and fund flows to trusteeship and disbursals within one platform. Built to offer ease, control, and security, it eliminates coordination gaps and simplifies complex escrow operations end to end.

Define your own triggers and rules for releasing payments, such as delivery confirmation, approvals, or due dates, ensuring smooth and controlled disbursal without manual overhead or dependency on external parties or communication.

Manage all collections and disbursals with minimal effort. Reduce manual tasks, eliminate repetitive actions, and streamline your escrow lifecycle with clean workflows powered by APIs and customizable approval mechanisms.

Manage everything from account setup and fund flows to trusteeship and disbursals within one platform. Built to offer ease, control, and security, it eliminates coordination gaps and simplifies complex escrow operations end to end.

Buyers and sellers stay protected from fraud, as funds remain securely held until verified delivery or agreed contractual terms are met.

Escrow resolves payment conflicts by securely holding funds until both parties meet clearly defined and mutually agreed-upon terms or conditions.

Ensure a seamless experience for everyone with guided steps, transparent fund monitoring, and streamlined, controlled payout processes.

Stay aligned with banking norms while reducing effort, paperwork, and audit concerns through structured, legally-compliant escrow practices.