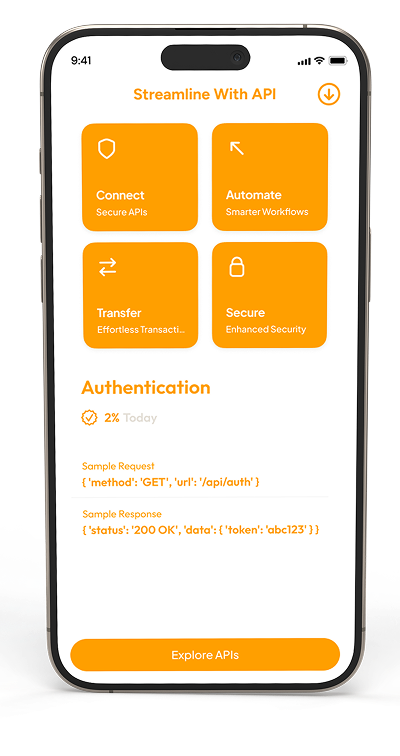

Streamline With API

Integrate essential banking functions directly into your platform. With secure APIs, power payouts, simplify collections, and control fund flow without logging into any dashboard. It’s fast, flexible, and built for developers who want more control.

Easily connect your applications with banking systems through plug-and-play APIs. This reduces development effort, speeds up deployment, and ensures you can launch new financial services faster.

Every payment, transfer, or balance inquiry is backed by enterprise-grade encryption and authentication. With robust monitoring, you can confidently safeguard sensitive financial data at every step.

Content: Whether you’re a startup handling small volumes or an enterprise managing millions of transactions, our APIs grow with your business. They adapt seamlessly to support evolving needs without disruptions.

API Banking connects your systems to essential banking services using simple, secure code. Create smarter workflows, automate transactions, and move funds without spreadsheets or manual intervention. Whether you're a startup or an enterprise, API Banking helps you streamline operations without disrupting your internal processes.

Initiate instant payouts to vendors or customers using API calls, eliminating file uploads, payment delays, and manual processing steps entirely.

Generate virtual accounts for users or vendors instantly. Streamline fund collection, payment monitoring, and internal account organization with ease.

Execute high-volume transfers or financial requests in one step using APIs to save time, reduce errors, and boost operational efficiency.

Receive structured data in your system for easy access, clean categorization, and deeper insights without changing platforms.

Initiate actions instantly and receive rapid confirmations to reduce delays, boosting efficiency across your financial operations.

Define how and when operations occur within your platform to maintain full control without depending on external tools or dashboards.

Build fully custom workflows around payment features without rewriting core systems or disrupting your product experience for end users.

Monitor, categorize, and review transactions from a unified interface that keeps every payment action visible, organized, and audit-ready instantly.

Use developer-friendly APIs with minimal code and clear documentation to implement complex financial tasks with ease and speed.